What Is FICA on a Paycheck? FICA Tax Explained - Chime

Por um escritor misterioso

Descrição

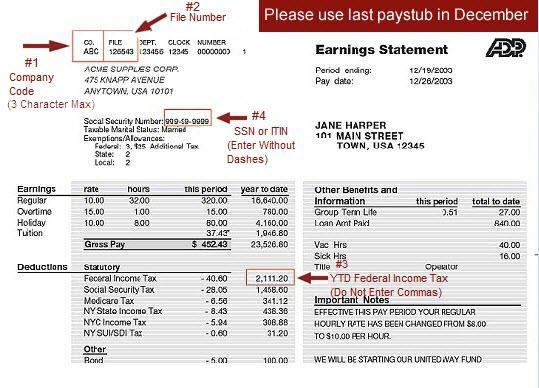

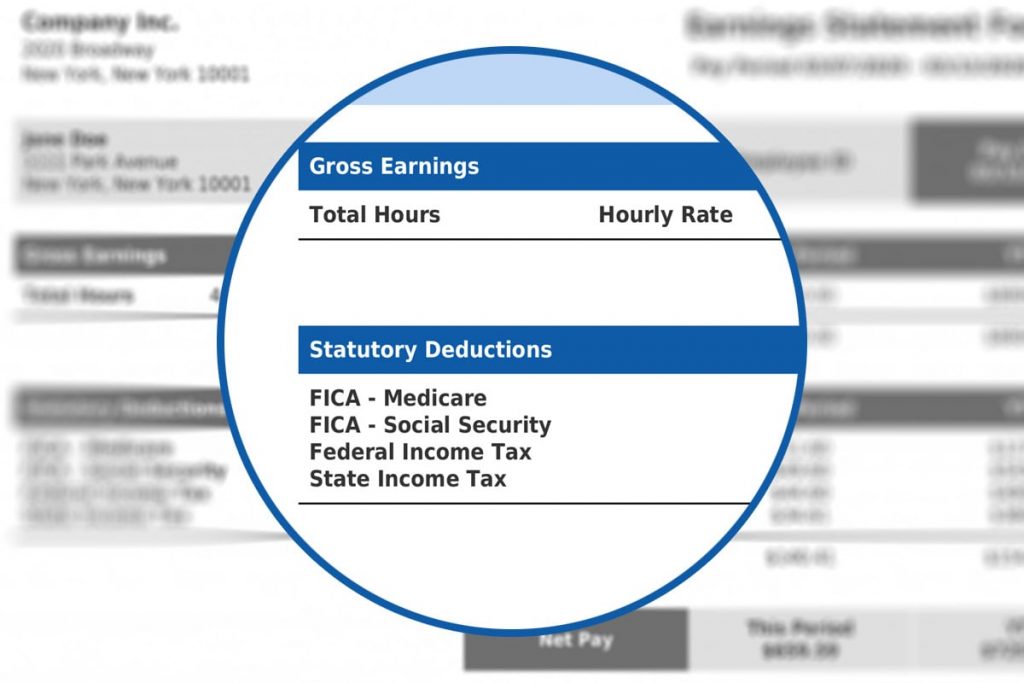

FICA taxes are mandatory deductions from your paycheck that fund Social Security and Medicare programs.

What Is FICA on a Paycheck? FICA Tax Explained - Chime

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

The Bonddad Blog: A modest proposal to use FICA-style tax withholding as a transition to “Medicare for All”

What Is FICA on My Paycheck? About Tax Withholding - 2023 - MasterClass

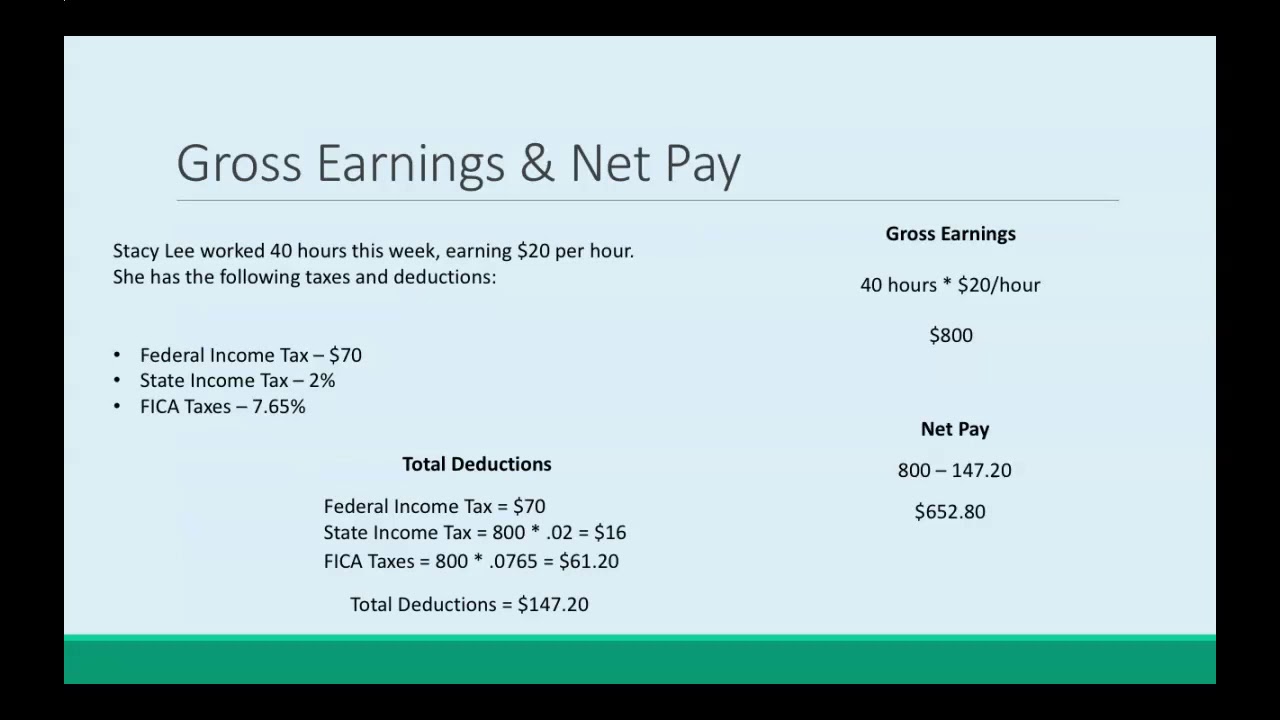

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes

FICA Taxes on Nonqualifed Deferred Compensation Plans

Payroll Journal Entries

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

What Is FICA on a Paycheck? FICA Tax Explained - Chime

What Are Pay Stub Deduction Codes?

What Is FICA on a Paycheck? FICA Tax Explained - Chime

Paloma Co. Stars has four employees. FICA Social Security taxes are 6.2% of the first $113,700 paid to each

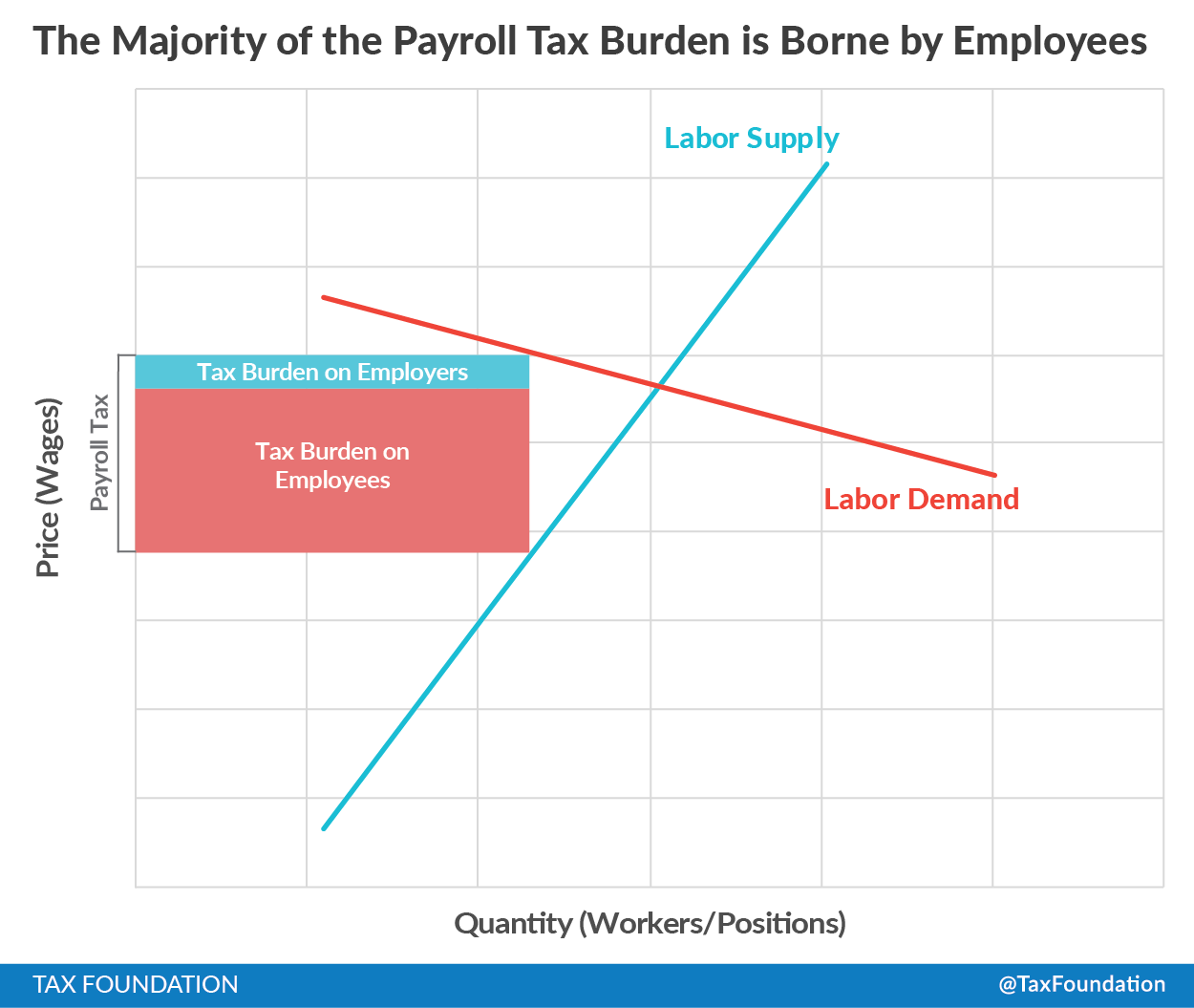

Payroll Tax Definition, What are Payroll Taxes?, TaxEDU

Who Is Liable For Employee Withholding and Social Security (FICA) Taxes, PDF, Payroll

FAQs + What to do about NYU's faulty FICA taxes – GSOC-UAW Local 2110

de

por adulto (o preço varia de acordo com o tamanho do grupo)