Students on an F1 Visa Don't Have to Pay FICA Taxes —

Por um escritor misterioso

Descrição

In general, non-US citizens employed in the U.S. are required to pay FICA taxes. However, those with single intent, or non-immigrant status (or F1 visa holders) are exempt from FICA taxes.

Are international students on F1-OPT exempt from Social Security and Medicare taxes if they have been in the US for more than 5 years? - Quora

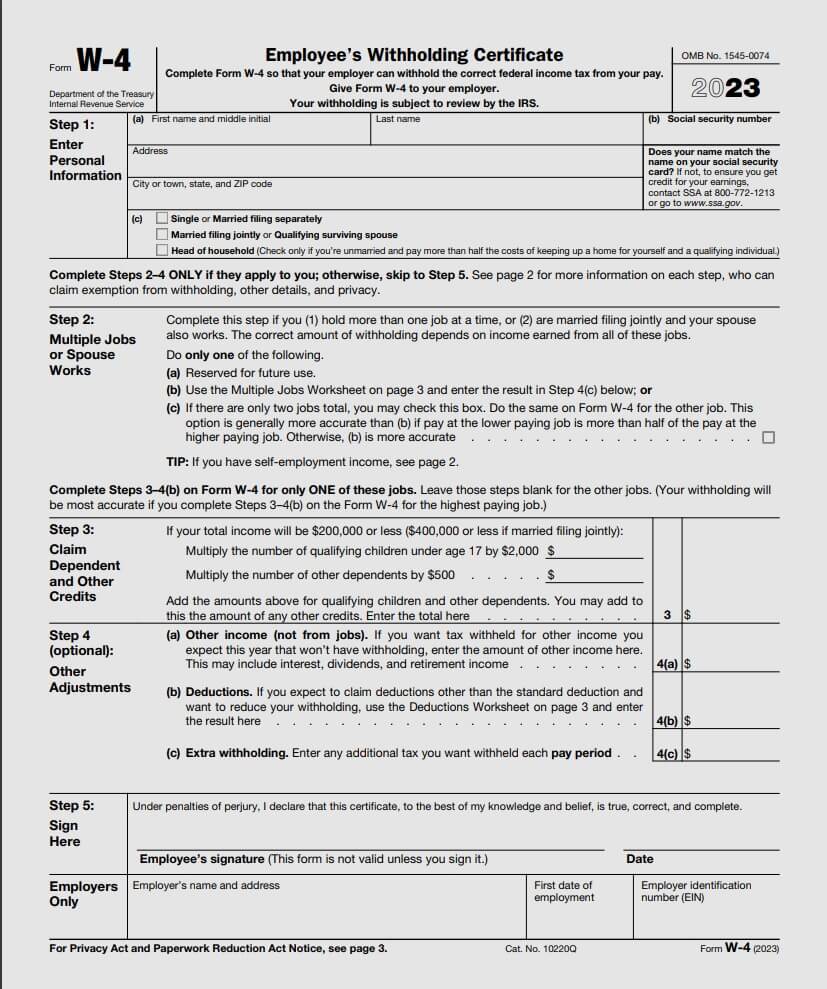

Filing Taxes When You've Been Employed On Campus

Filing Taxes as a Non-Resident > International Student and Scholar Services

The Complete J1 Student Guide to Tax in the US

F-1 International Student Tax Return Filing - A Full Guide [2023]

All About F1 Student OPT Tax F1 Visa Tax Exemption & Tax Return

Pros and Cons : Working in OPT or H1B Visa

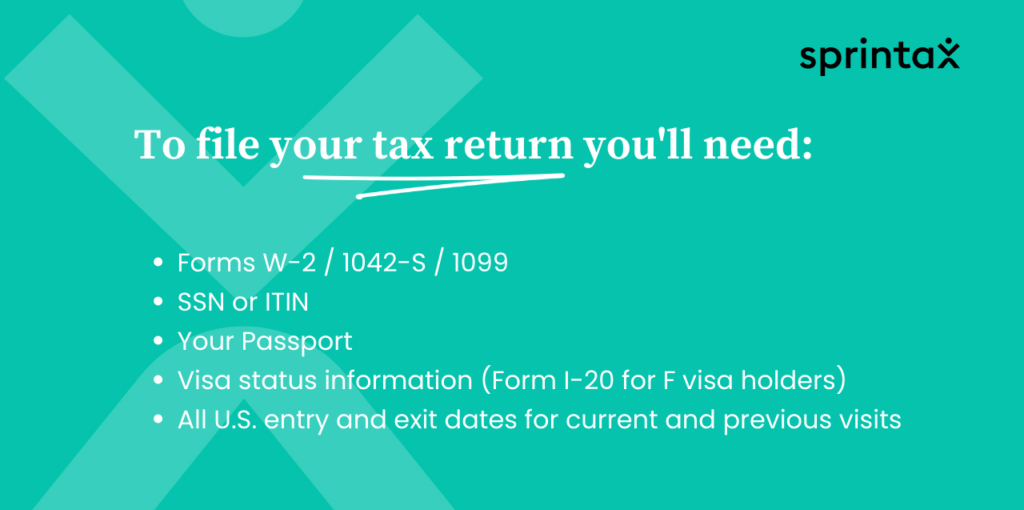

5 US Tax Documents Every International Student Should Know

US Tax Return & Filing Guide for International F1 Students [2021]

F-1 International Student Tax Return Filing - A Full Guide [2023]

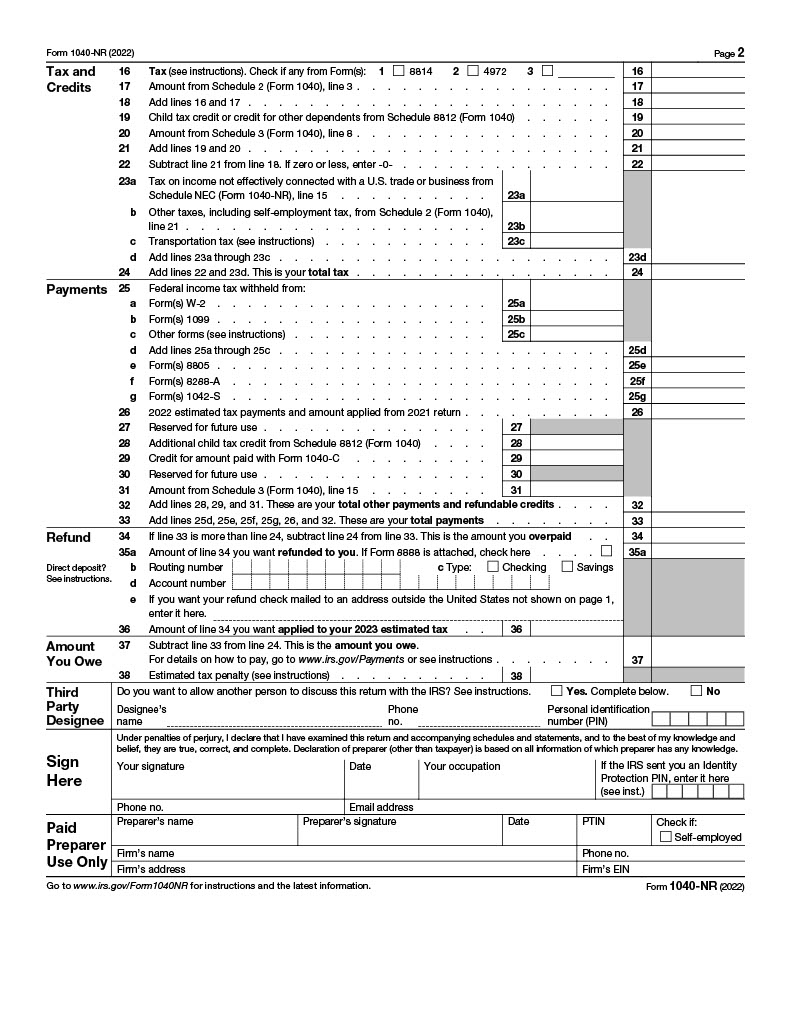

Filing Your Non-Resident Tax Forms using Sprintax (F and J)

Students Taxes: Education Tax Credits, Deductions, & FAFSA

How Are Bonuses Taxed? - Ramsey

de

por adulto (o preço varia de acordo com o tamanho do grupo)