What is a K-1 Trust Distribution? - CPA Firm, Accounting & Taxes

Por um escritor misterioso

Descrição

Trust and estate income tax returns under the TCJA - Journal of Accountancy

The Basics of Fiduciary Income Taxation The American College of Trust and Estate Counsel

How Schedule K-1s Are Used

Income Tax Accounting for Trusts and Estates

Best Tax Software For Estates And Trusts

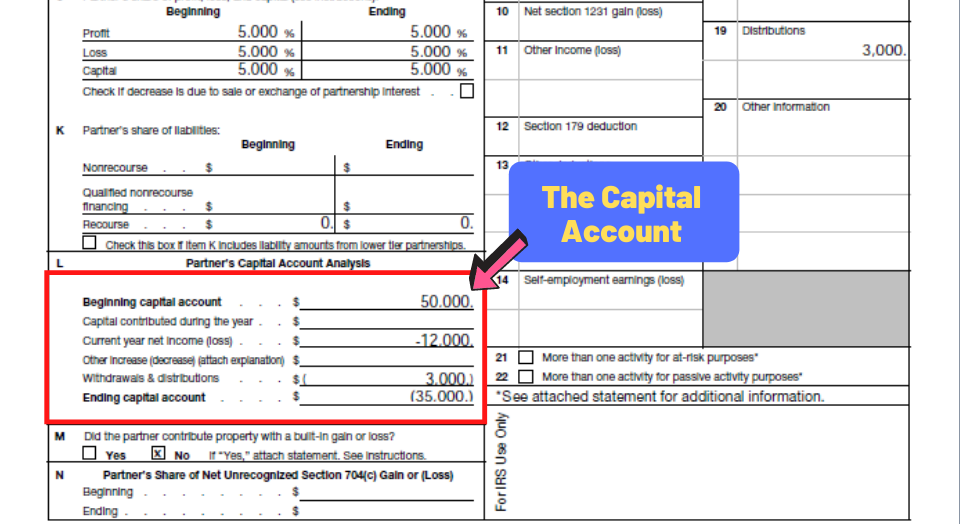

Schedule K-1 Tax Form for Partnerships: What to Know to File

What is a K-1 Trust Distribution? - CPA Firm, Accounting & Taxes

Fiduciary tax 101

Simple vs. Complex Trust, Definition & Differences - Video & Lesson Transcript

Publicly traded partnerships: Tax treatment of investors

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)

What Is IRS Form 1041?

How to Find the Best C.P.A. or Tax Accountant Near You - The New York Times

On form 1041, beneficiaries get divs & int on form K-1. Yet, the TT business wrongly adds that income to the trust. How is div/int excluded from trust income?

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate Explained

de

por adulto (o preço varia de acordo com o tamanho do grupo)