Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Descrição

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

Shopify Help Center Location-based tax settings

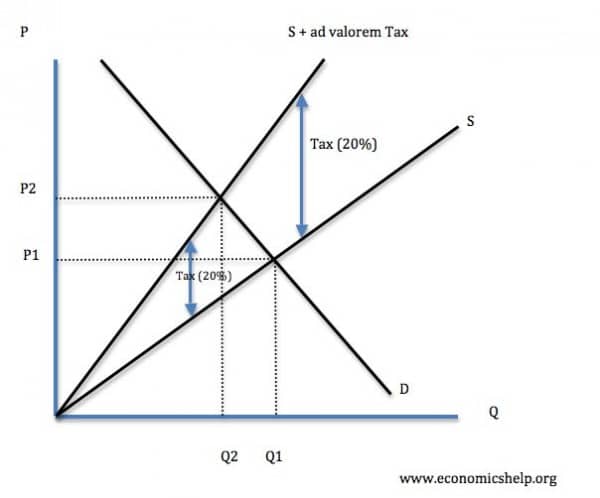

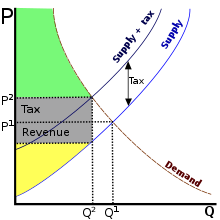

Value added tax: VAT: Exploring the Impact of VAT on the Tax Wedge - FasterCapital

Ad valorem tax - Economics Help

Taxation in the United Kingdom - Wikipedia

Indirect taxes

Value-added tax - Wikipedia

VAT: a brief history of tax, Tax

Tax Incidence: How the Tax Burden is Shared Between Buyers and Sellers

Value Added Tax (VAT) - Overview, How To Calculate, Example

2023 International Tax Competitiveness Index

Effects of taxes and benefits on UK household income - Office for National Statistics

de

por adulto (o preço varia de acordo com o tamanho do grupo)